32+ council tax refund letter sample

Or is a constituted authority organized by a state or local. We give 100 refund for an assignment that we cant complete that had been paid for.

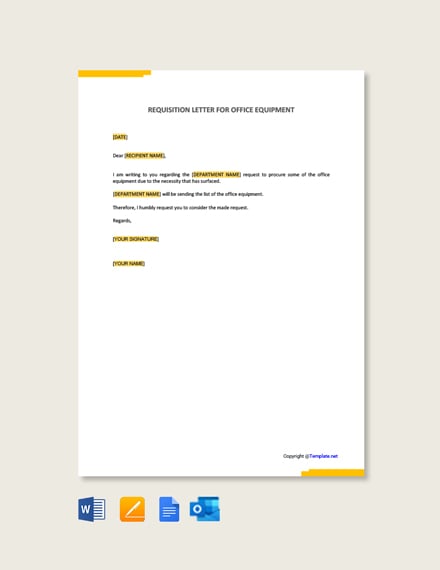

Download 32 Equipment Sample Letter Of Request Islamique Background Hd

The assessors in each town except as otherwise specially provided by law shall on or before the fifteenth day of October annually post on the signposts therein if any or at some other exterior place near the office of the town clerk or publish in a newspaper published in such town or if no newspaper is published in such.

. We offer free revision as long as the client does not change the instructions that had been previously given. Acts 1981 67th Leg p. B re longevity payments.

In case a client want to alter the instructions revision can be done but at a negotiated fee. In case a client want to alter the instructions revision can be done but at a negotiated fee. My annual net income in my introductory letter will be different from the one on my online application form due to the Coronavirus Tax rebate from my government to all health workers from May to December 2020 because I am taking a new introductory letter from my boss with a current date.

An extension of credit to a participant in an employer-sponsored retirement plan qualified under section 401a of the Internal Revenue Code a tax-sheltered annuity under section 403b of the Internal Revenue Code or an eligible governmental deferred compensation plan under section 457b of the Internal Revenue Code 26 USC. It was suggested by James Tobin an economist who won the Nobel Memorial Prize in Economic SciencesTobins tax was originally intended to penalize short-term financial round-trip excursions into another currency. 91-32 deleted obsolete references to July 1 1979 and made technical changes.

We offer free revision as long as the client does not change the instructions that had been previously given. A Tobin tax was originally defined as a tax on all spot conversions of one currency into another. C An entity is subject to the franchise tax for a tax year in any portion of which the entity is in violation of an order issued by the Texas Department of Insurance under Section 2254003b Insurance Code that is final after appeal or that is no longer subject to appeal.

D A multifamily rental property consisting of 36 or more dwelling units owned by the organization that is exempted under Subsection b may not be exempted in a subsequent tax year unless in the preceding tax year the organization spent for eligible persons in the county in which the property is located an amount equal to at least 40. B to permit credit for longevity purposes for other state service or service as an elected official of the state or any combination of service effective June 30 1993. According to a 2011 IRS Advisory Council IRSAC report the RCA makes incorrect determinations in 55 of all penalty abatement requests.

Sales Tax Holiday Refund Requests. The seller can either grant the refund or provide their customer with Form 00-985 Assignment to Right to Refund PDF which allows the purchaser to file the refund claim directly with. We give 100 refund for an assignment that we cant complete that had been paid for.

The program is for tax professionals and is designed to provide uptodate training on current tax law regulations and updates. This years program will review recent cases and rulings and key legislation provide an indepth review and analysis of a number of tax areas and cover newly enacted regulations and procedures critical to. If you pay sales tax on qualifying items during the sales tax holiday you can ask the seller for a refund of the tax paid.

Notice requiring declaration of personal property. The receiving Tax Examiner TE assigns the EINs and e-mails them encrypted back to the RA or. Meets the conditions for issuing tax-exempt bonds as set forth in Rev.

Answer Yes if the organization has received a letter ruling that its obligations were issued on behalf of a state or local governmental unit. IRM 31427 Notice Review-BMF Tax Examiner Review instructs Notice Review Tax Examiners TEs to send photocopies of returns andor notices to Entity for review of. 26 A 2012 TIGTA report stated that of its sample of abatements determined using the RCA 89 were incorrect.

By the late 1990s the term Tobin tax was being applied to all forms of short term. We would like to show you a description here but the site wont allow us. Blindif an eye doctor has certified that you are legally blind in both eyes - Blind Persons Property Tax Exemption Application-pdf updated for 2021 Circuit Breaker Renter if you are over 66 years of age or a widower and your household income for 2020 was less than 34666 - Renter Refund Application-pdf updated for 2021.

4 Free Sample Of Doctor S Excuse Note Templates With Dr Notes Templates Best Professional Templates Doctors Note Template Doctors Note Notes Template

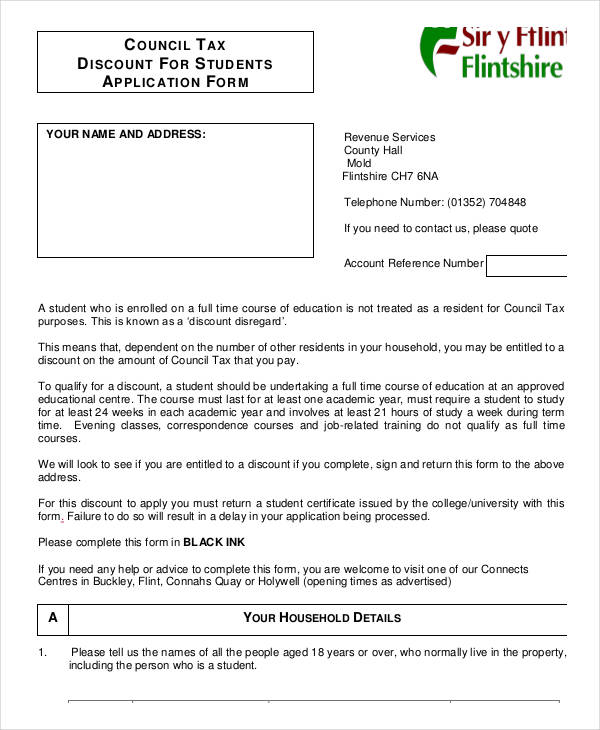

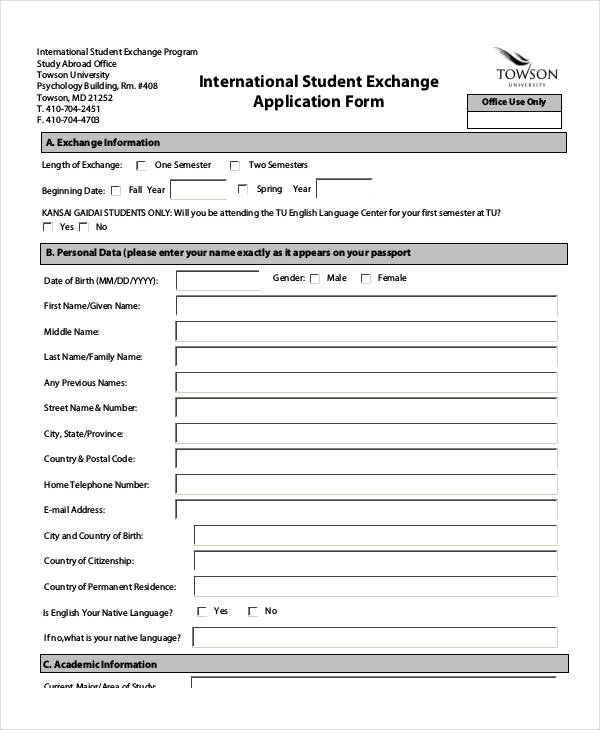

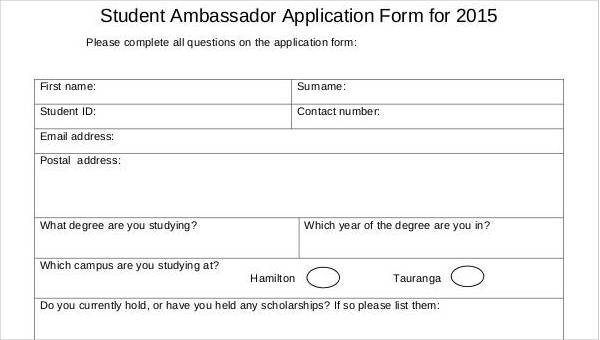

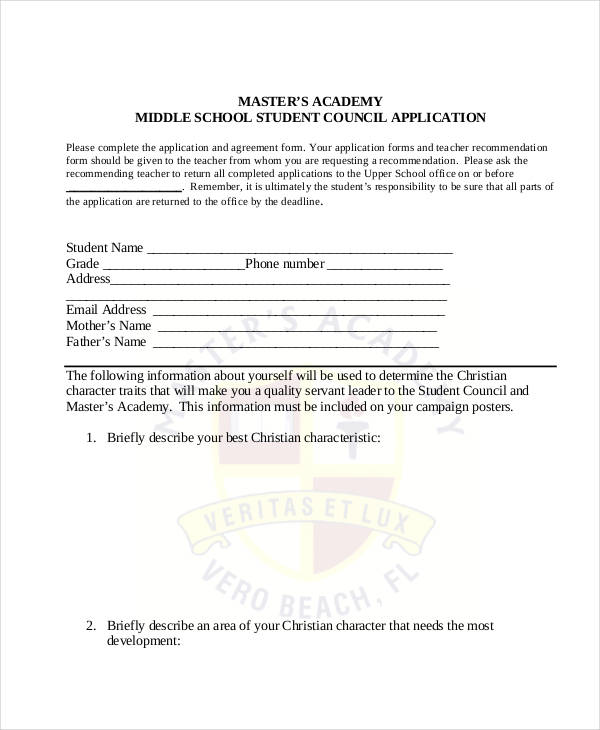

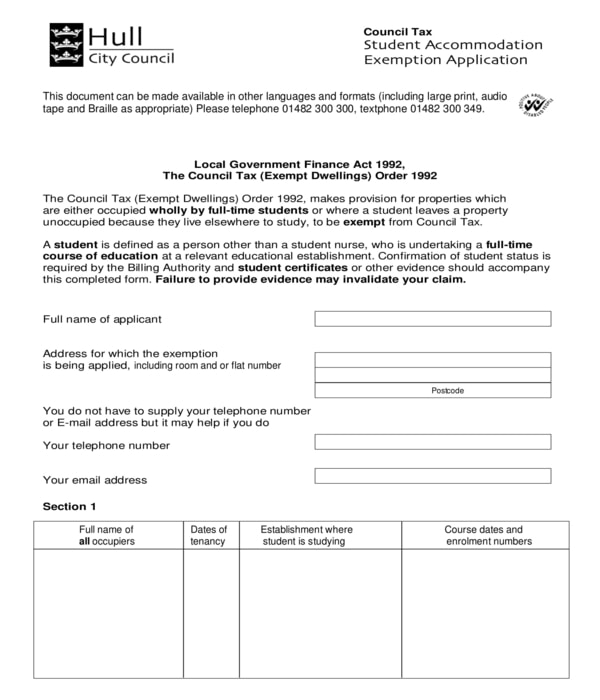

Free 32 Student Application Forms In Pdf Ms Word Excel

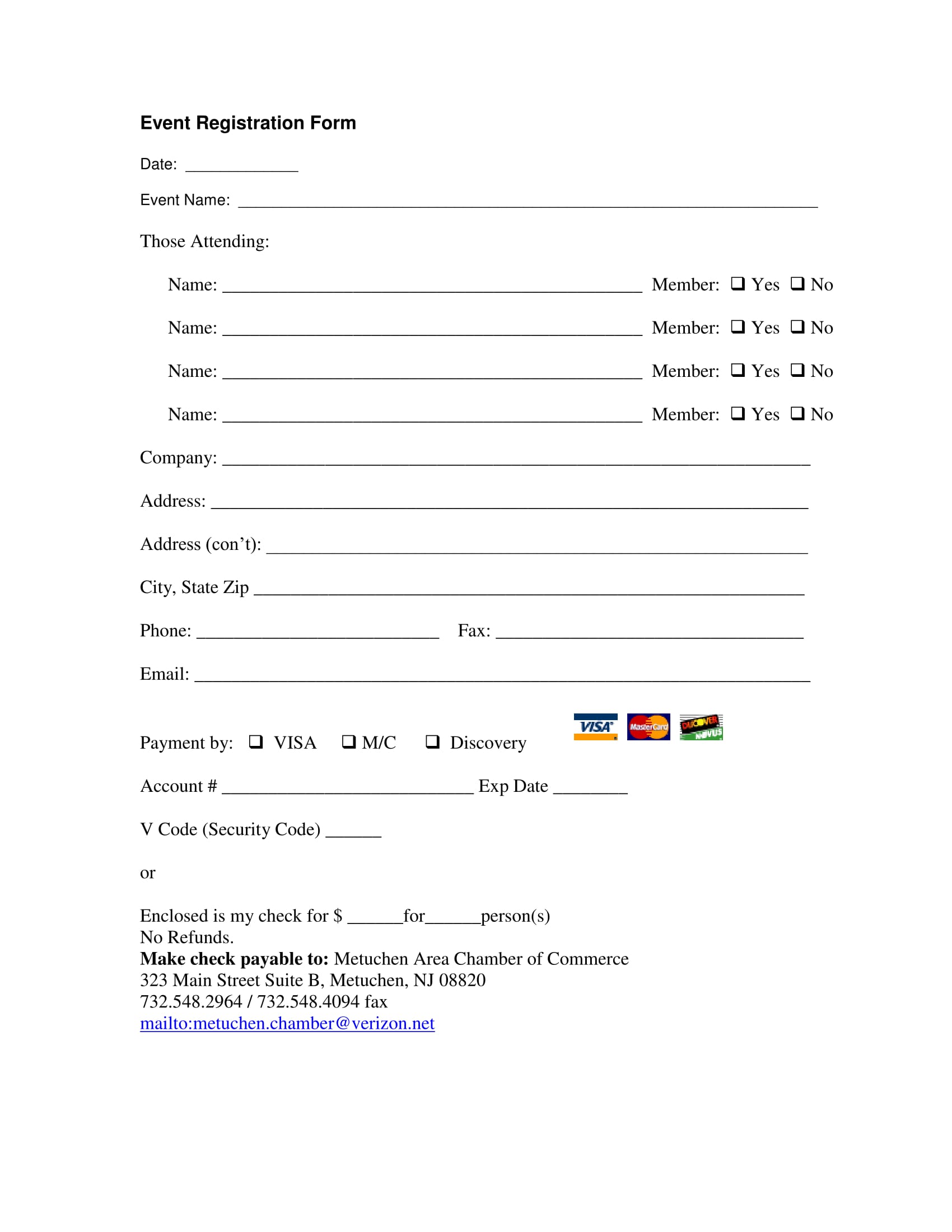

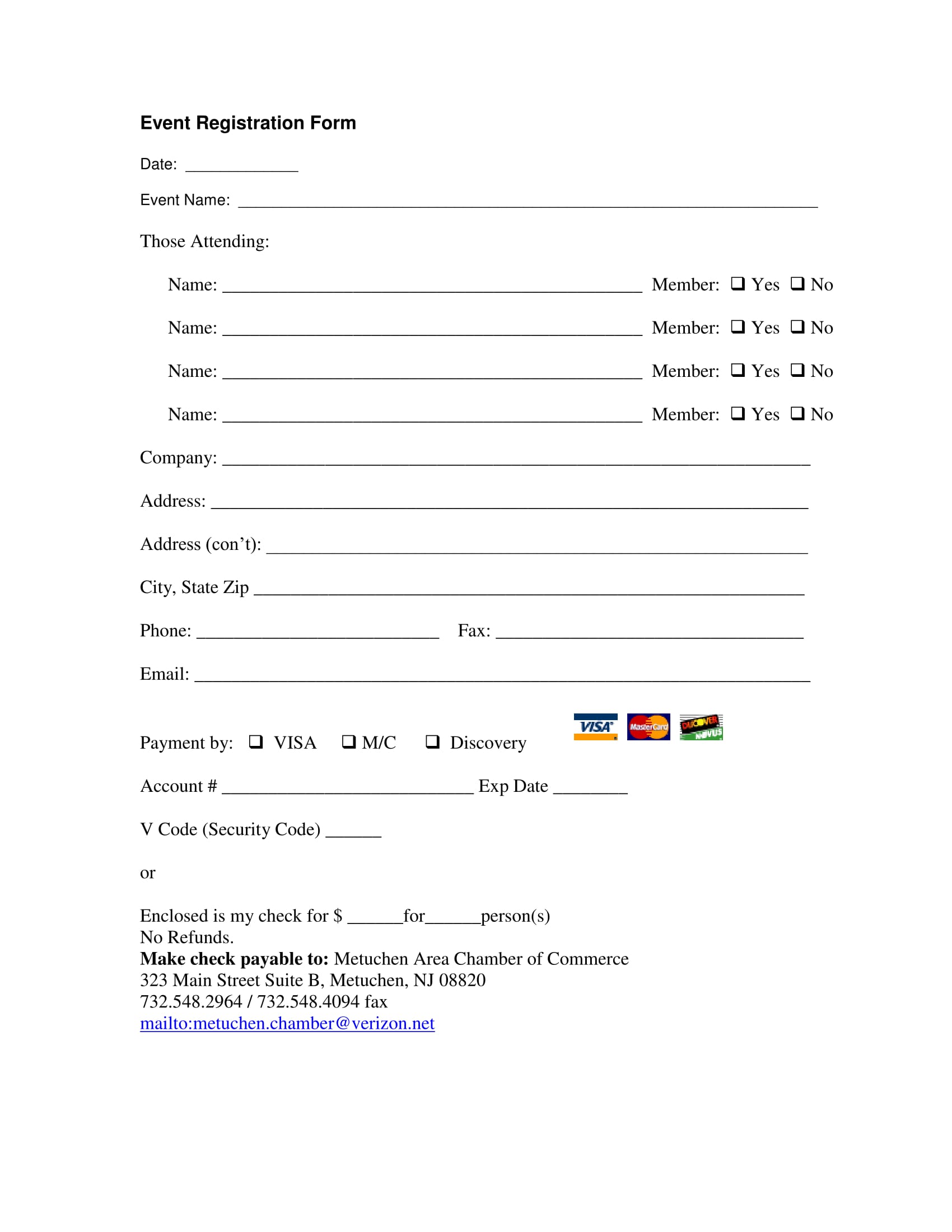

Free 32 Event Registration Forms In Pdf Ms Word Excel

Free 32 Student Application Forms In Pdf Ms Word Excel

Free 6 Sample Attendance Allowance Forms In Pdf Ms Word

Free 32 Student Application Forms In Pdf Ms Word Excel

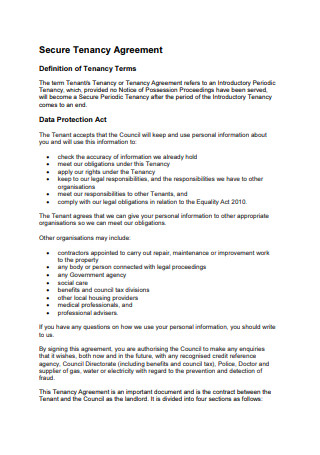

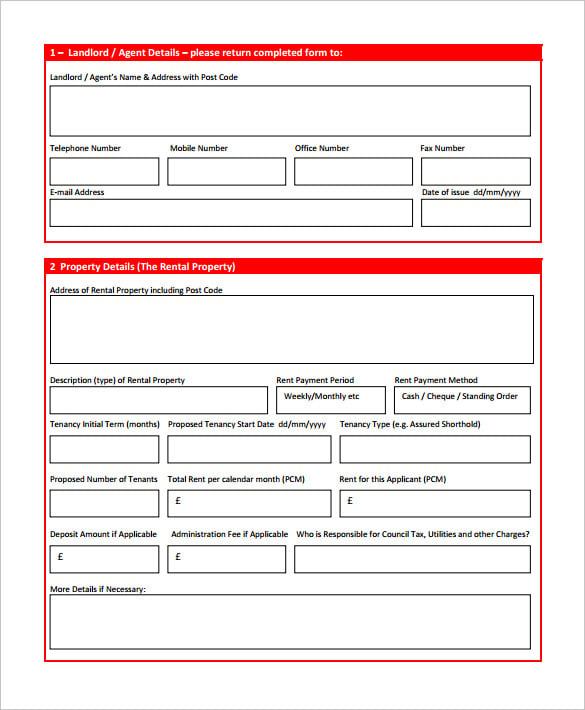

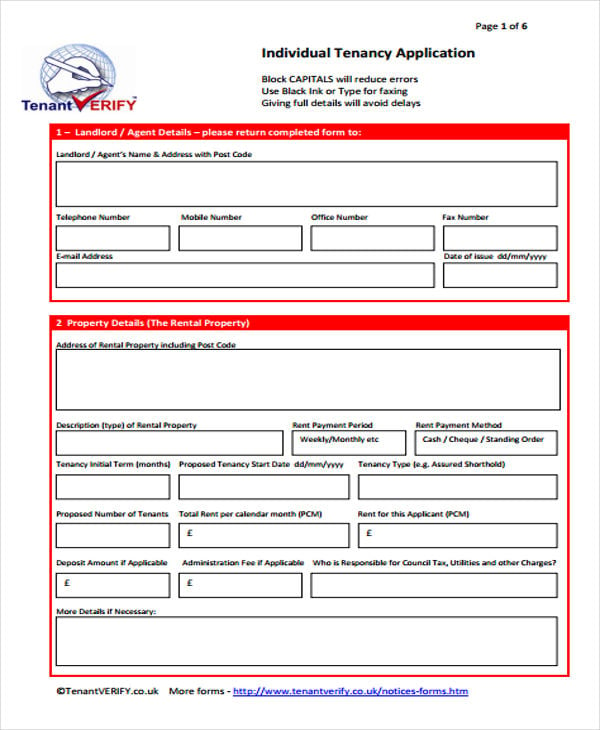

Rental Application 21 Free Word Pdf Documents Download Free Premium Templates

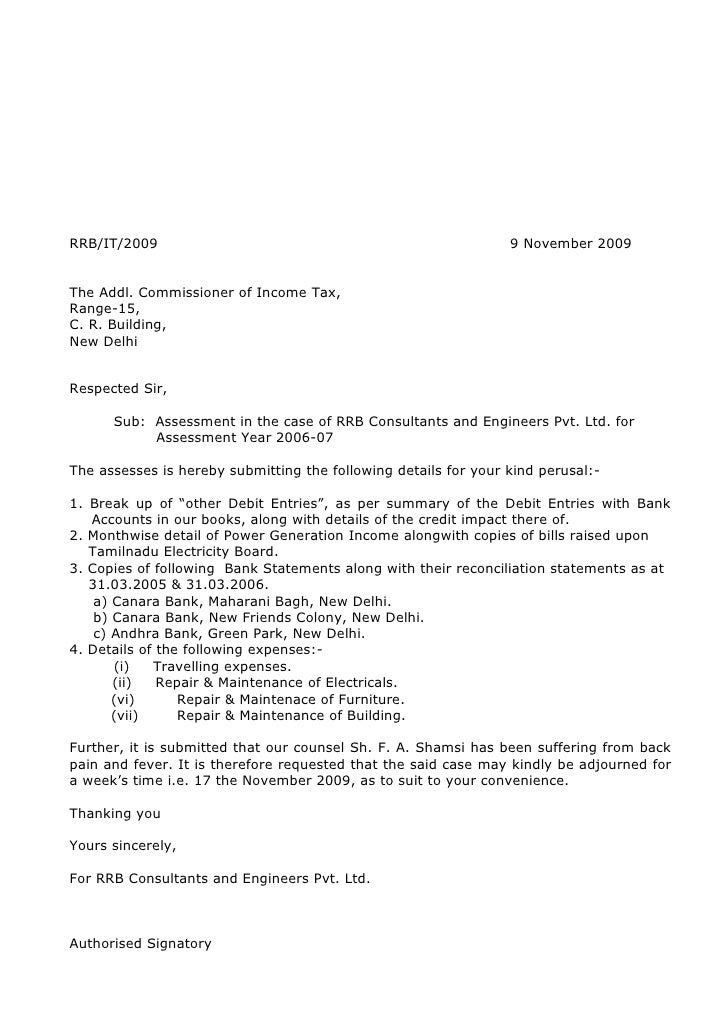

Download 22 Sample Letter House Rent Allowance

28 Rental Application In Pdf Free Premium Templates

Free Download Bank Account Authorization Letter Lettering Letter Sample Consent Letter

Fax Letter A Big Collection Of Free Fax Letter Templates And Forms For Electronic And Paper Letter Templates Business Letter Template Cover Letter For Resume

Penalty Fare Appeal Letter Template Prahu Intended For Pcn Appeal Letter Template 10 Professional Templates Ideas 1 Letter Templates Lettering Templates

Los Angeles County Employment Verification

Free 18 Student Application Forms In Pdf Ms Word Excel

Sample Response To Irs Notice Form Template Irs Irs Forms No Response

Explorations The Girl Scouts Hornets Nest Council

10 Retail Budget Templates In Doc Pdf Free Premium Templates